For years I advocated for profit sharing instead of stock options for compensating team members.

My reasons for going against the grain of common startup advice came down to:

- Without selling ConvertKit (which I don’t want to do) the equity doesn’t have value.

- Most stock options aren’t ever worth anything, so employees who take a reduced salary in trade for more options usually make less.

- Team members are better off with profit sharing than the hope of a stock proceeds in the distant future.

This last year I changed my mind and issued over $4 million in stock options to the ConvertKit team. I also carved out a larger pool for future hires and additional bonuses.

Here’s what Charli Prangley, our marketing designer, had to say in a Slack direct message a week after receiving the options:

“I didn’t think equity was that important to me, having never found it to be much of a motivator at previous companies, but the difference is I didn’t believe whole heartedly in them like I do in ConvertKit. The stock options mean more to me than I ever would have thought, and I can’t explain the sense of peace and stability I feel knowing that ConvertKit is a team I’ll be on for a very long time.”

“Thank you for sharing a piece of this amazing company you’ve built with me.”

Why the change?

Part of the reason is my answer to the reasons above changed, but the biggest factor is simply that I realized that after another 10 years of building ConvertKit I would be very wealthy and the majority of my team would not.

Playing that scenario forward it didn’t sit well.

We created something of extraordinary value and everyone who worked on that should be rewarded with more than a salary.

I still firmly believe in profit sharing and didn’t make a single change to our profit sharing formula. In fact, at our retreat last week we distributed a record $340,000 to the team (for the second half of 2018). That puts the total profit sharing at over $1,000,000 in just a couple years!

The other objections

I still think my original objections to stock options are valid, I just have a more nuanced opinion over time. Let’s tackle them one at a time.

Most stock options aren’t ever worth anything

That’s true. I’ve heard countless stories of talented people working for a reduced salary in trade for equity. In nearly every case they would be better off at the full salary and no options. Simply because most companies fail.

But ConvertKit hasn’t failed. We’ve built something immensely valuable that tens of thousands of creators are happy to pay for every month. We grew 43% last year and expect to keep growing far beyond our current $14 million in revenue.

Investors reach out every day asking to invest or purchase equity. What we’ve built has value. Also I’m not advocating for a reduction in salary or profit sharing. Issuing options is addition to what we already have.

Eric Jorgenson has some more great points about why stock options can be overvalued if you’re interested in more on that.

Can the stock have value without an exit?

By avoiding venture capital and the typical startup swing-for-the-fences mentality, I avoided focusing on an exit. Instead I planned to build ConvertKit for at least the next decade.

I reasoned that without the possibility of an exit, the shares had no value. But at the same time I was spending over a million dollars buying back equity from my technical co-founder who had largely worked for equity in ConvertKit. His equity had considerable value, all without an exit.

Plenty of companies have equity sold on a secondary market without raising capital that goes into the business. Two of the most famous examples are Basecamp and Atlassian. David wrote a great post about the day he became a millionaire.

In 2006 Jeff Bezos purchased shares of Basecamp from Jason and David. It wasn’t an investment, because the money went to the founders personally, rather than into the business.

In 2014 Atlassian raised a round from institutional investors, but the money was to give liquidity to the founders and team members, not as growth capital into the business. Early team members were able to sell some equity without having to wait until the IPO.

Over the next few years I plan to make it possible for team members to sell some of their shares (if they want to for a house down payment or something similar). This could be through ConvertKit buying the equity back or allowing a trusted outsider to purchase their shares.

Team members are better off with profit sharing than the hope of a stock proceeds in the distant future

Anything can happen. Even some of the best companies and products fail. That’s why I believe in making a good living along the way and not delaying all of the reward for years.

Profit sharing allows us to celebrate wins every six months. Equity will reward us for what we are able to build that into over a decade.

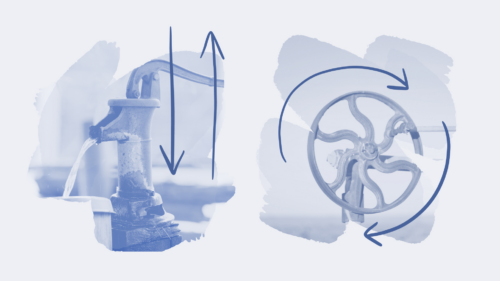

I think of compensation in two categories: short vs long-term and guaranteed vs performance based.

For short-term compensation at ConvertKit we offer both salary (guaranteed) and profit sharing (performance based). But we don’t want team members to only be focused on now, so we also offer long-term compensation through a 401k match (guaranteed) and equity (performance based).

The point isn’t to increase one category at the expense of another, but instead to find a healthy balance between them. Healthy short-term compensation will allow a team member to hold onto equity for a long time to truly see the upsides.

Adam Jones on our engineering team said, “Profit sharing creates strong personal incentives to care about the short term. Options help me balance that with similar long-term incentives.”

Other logistics

There were a few other logistics or concerns with issuing equity that I’d like to address.

- The longer you wait the more you’ll give to the IRS

If I had issued equity sooner then I could have done more through equity, rather than options, with a smaller amount paid in taxes. But because I waited until the company had significant revenue the price on the options was higher. - We issued options as an LLC

I always thought that in order to issue options we would have to switch from an LLC to a C-Corp. After consulting with our attorneys, that’s simply not a requirement. We were able to stay as an LLC which is more beneficial to us as a profitable company where I own the majority. - Carta is great for managing options

We moved all of our equity management to Carta. They’ve been great (though the setup process was more involved then I expected). I’ve really enjoyed how easy it is to sign in and issue options to a new team member. - These options vest over four years, after a one year eligibility period

Vesting over four years is standard, but I decided to do a one year eligibility period, rather than a cliff. Meaning that options will start vesting after they have been at the company for at least a year.This is to avoid a date where anything big changes. I don’t want to encourage someone to stay longer than they should and I also don’t want to worry about firing someone who is about to reach their cliff.

So there you have it: the story and details on why I reversed course on a strongly held belief. There isn’t one option that is right for everyone, but I hope my story helps shape your opinion on what’s best for your team and company.

Another great article Nathan, you have certainly influenced how I think about compensation!

Thanks Glenn!

Very interesting article as always…

“Team members are better off with profit sharing than the hope of a stock proceeds in the distant future” .

really interesting insights Nathan :) thanks!

I really enjoy the transparency of these articles Nathan, thanks for sharing.

Isn’t this what people do when they’re still “playing business”, before product/market fit. The CEO of a successful business usually has more important decisions to contemplate and execute on.

The reason you, as the owner, SHOULD reap all the rewards long-term is because you started and funded the business, risking everything and didn’t even get paid a salary for years. While your team took no significant risk and instead chose to work for you in exchange for a steady paycheck.

If you have psychological/philosophical misgivings with regards to accruing wealth, maybe you should make ConvertKit a worker cooperative. But what about past employees or contractors who contributed?

How about restructuring ConvertKit as a customer cooperative society. After all, employees are already compensated via their salary. The money originates from customers, is used to compensate the team and cover costs, then the surplus should flow back to the customers.

I think you could successfully argue that the owner took the risk and they should be rewarded for it. But I don’t agree that the owner should get get all the rewards.

“If you have psychological/philosophical misgivings with regards to accruing wealth, maybe you should make ConvertKit a worker cooperative.”

Actually, I feel great about becoming fabulously wealthy! I just don’t need to optimize for every penny…except in this by penny I mean “million dollars.”

I appreciate the suggestion, but I like the way we structure ConvertKit to serve creators right now.

Thanks for sharing, Nathan.

Really great insights. I especially like the matrix of short vs long-term and guaranteed vs performance based. Thanks for sharing, Nathan.

Interesting, but what I wonder if all this is compatible with your values around A-players.

A growing body of research shows that intrinsic motives are more effective than extrinsic rewards, and that monetary rewards (like bonuses and options) disrupt or even completely override intrinsic motivation. Increasing team rewards can paradoxically harm performance, engagement and retention.

The best A-players tend to have a high level of intrinsic motivation and personal fulfillment. These are people who take ownership and go above and beyond to help the team move forward. These same people are often subconsciously alienated by extrinsic rewards or status. Compensation schemes that subvert intrinsic motivation may repel your best team players and simultaneously attract the wrong sort of applicants to replace them.

I don’t think rewarding team members for their contributions is going to hurt our a player mentality. I agree you should work with people who care about more than money, but working hard to build wealth for yourself and your family is an admirable trait.

A good balance view between long term and short term view of the company. Convertkit will grow, but the challenge in the future is to make sure company get customer success and happiness. Wish you all the best in the future.

Very interesting article. I liked it. Thanks for sharing.

Howdy Nathan! Really appreciate your thoughts on this, it makes a lot of sense.

One question though – did you backdate the eligibility period to start dates, is it going forward from the time you made this policy change, are you skipping the eligibility period for employees who were there already or something else?

Really curious about that. Thanks again!

Yes, everyone who had been at ConvertKit for at least a year didn’t have to go through the eligibility period.

Thanks for replying! It’s pretty awesome to see someone who isn’t trying to pull a fast one on their team when it comes to things like equity.

Wow. Really, really helpful as we are wrestling with some of the same decisions. Thank you for your transparency and willingness to share.

Nathan – I greatly appreciate your sharing your thought process and relate very much to these precise issues. Thank you! If you have the time, I’d really value your answers to the following questions:

1) If you’re able to divulge, what percentage of equity did you set aside for options? Both for now and to allow for future growth?

2) How did you decide how much each employee received? Particularly for the earliest employees who have already been around awhile?

3) How did you get your initial valuation for the option price? And were you tempted to set it lower for folks who came on board when the company was valued at much less?

4) Considering the overhead, effort to setup and manage, etc. for a small company to offer stock options…how big do you think a company should be before taking on the effort?

Thanks!

I love this. You’re clearly aligning the incentives of the employees with the long-term success of the business. Get that part right and I’ll bet a lot of other problems take care of themselves!

I think it’s even more interesting in the context of your previous post about consumer surplus. This feels like the kind of change that would also build “employee surplus.” What a great way to build a strong and committed team.

Hey Nathan, do you offer new options every year to keep your tea motivated to strive to get even more equity, or is it a one time thing that happens during your first 4 years of being an employee at Converkit?