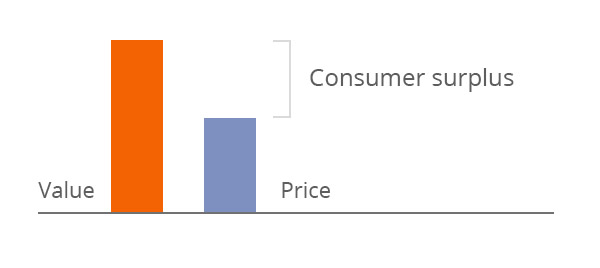

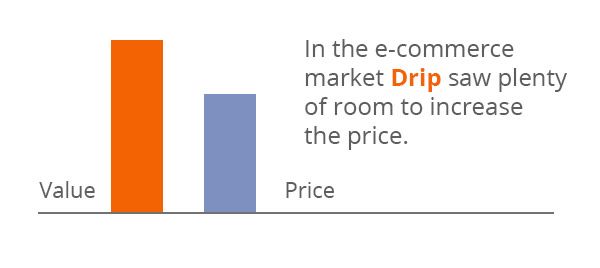

Think about the difference between the value you receive from a product and the price the company charges for it—often referred to as consumer surplus.

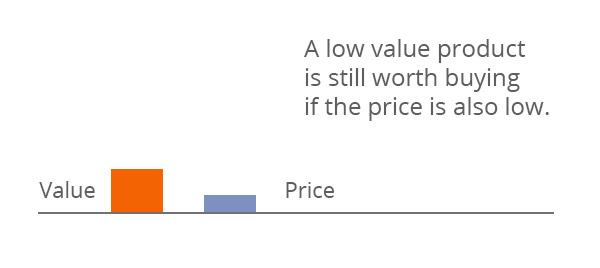

A company with a low price that provides a minimal amount of value would look more like this:

Customers are happy to pay because the value still exceeds the price. A $9 product doesn’t have to deliver that much value to make it worth purchasing.

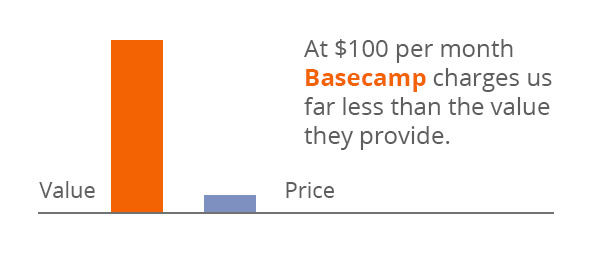

Charge more is common advice because many small companies often provide an incredible amount of value and charge a low price. Take Basecamp for example: their price is $100 per month.

With 38 team members my first thought is, “per user? That’s a quite high!”

But wait, they mean $100, flat. For everyone.

At ConvertKit we get so much value from Basecamp that if they doubled their price we wouldn’t blink. Really, they could 10x our price to $1,000 a month and they would still provide more value for us than we’d be paying.

Now they choose to keep their pricing super simple and leave that money on the table and many customers love them for it (it’s still a poor financial decision, but the great thing about owning your company is you can do that).

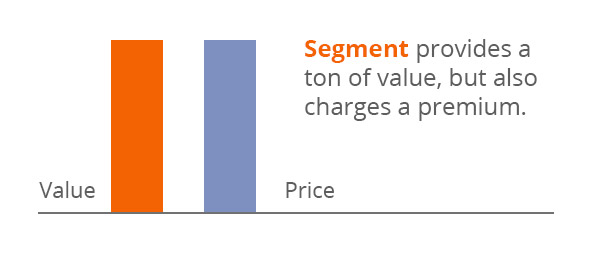

For us Segment is on the opposite end of the spectrum. They provide an incredible amount of value managing our data across apps, but they charge a ton for it. The high value is equally matched by a high price, not leaving any surplus.

Then whenever a slight gap opens up between the value they provide and the price—that gap that builds customer goodwill—they raise the price and close it. Requiring a price increase of $30,000 per year and even more contract lock in. The result is more money for them, but we end up resenting a company that we’d normally love—if they would just consider leaving some value on the table.

Intercom is also continually squeezing the consumer surplus in our relationship with them. They provide a super valuable service, but they charge a premium for it. That has made them one of the fastest growing SaaS companies of the last decade, but they don’t have as much brand goodwill with their customers.

This equation is different for every customer. That’s why SaaS companies use pricing plans or variable pricing (per user, per subscriber, etc) to capture more of the value. A ConvertKit customer with just 3,000 subscribers pays us $49 a month, but a creator with 100,000 subscribers pays us $679 a month. Some who receive considerable value are willing to pay quite a bit more.

Choose your customers

Industry matters as well. Drip, one of our competitors, recently made the move into email marketing for e-commerce and found that the standard rates paid per subscriber are much higher compared to other industries. That’s because commerce companies tend to have a higher revenue per subscriber than bloggers.

So Drip raised their prices to capture more of this surplus.

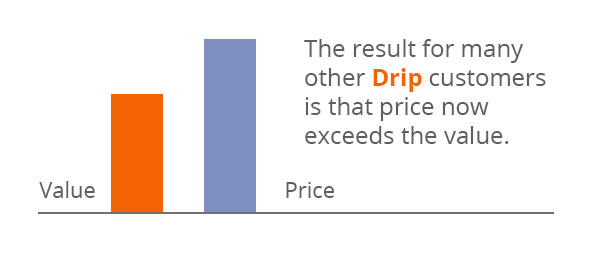

Some customers didn’t care, but those who already felt like they didn’t have a consumer surplus with Drip revolted and left the platform.

They could have done a few things to prevent that (grandfathering customers, better communication, etc), but the biggest difference would have been providing more value in the areas customers saw them as weak (deliverability and customer support). Unfortunately for certain customers, Drip changed the price when the value wasn’t there to justify it.

Long term I think the price increase will be a good move for Drip’s revenue. There is consumer surplus at their new price in the new market. By leaving some customers behind they’ll make more revenue long-term.

What does it mean for your business?

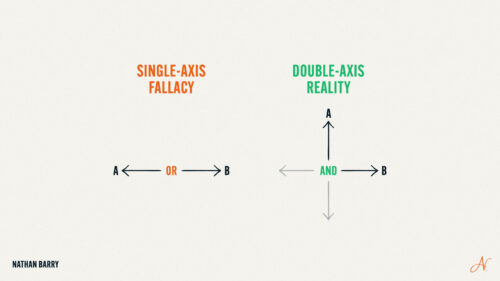

As you evaluate your pricing consider how much value you provide for each segment of your market. There may be room to raise your price, capture more of the consumer surplus, and earn more revenue. But keep in mind you may be leaving some customers behind and the remaining customers may feel less goodwill.

Goodwill is generic, so let’s look at tangible benefits for your business in not charging for all the value you deliver:

- More referrals — Friends were talking about how much value they get from Zapier for $49 per month. As a result of the thread they referred a few more new customers for Zapier. I’m certain the team at Zapier knows they could charge more (and they do for some segments), but they value how easily shared their product is for a broad market.

- Faster organic growth — That goodwill and referrals will result in higher conversions without having to engage a sales team, leading to faster organic growth. If a really efficient company is important to you, this can be to your advantage.

- Lower churn — The lower the price, the less likely someone is to search for another solution to their problem. By keeping a nice value buffer you avoid customers even considering switching away from your product.

When evaluating your own price to value ratio consider all of these factors. You certainly don’t want to leave too much money on the table, but you want to make sure there is a healthy amount of value for the customer after subtracting the price they pay.

With smart segmenting and a solid pricing strategy you can strike the right balance between creating goodwill with your customers and building a healthy foundation for your business.

Awesome article, Nathan. The price to value ratio is a great way to think about pricing strategy. But clearly it’s harder to quantify the “value” part of the equation. What are your thoughts on that? Do you get at that number through some proxy metric?

Do you feel it is valuable to try and offer varied consumer surplus to different customers receiving the same product – outside of what you mentioned by grandfathering/communicating? In SaaS this seems controlled by quantity of features and limitations on tasks. But what about in commodity industries?

Short, well written, easy to understand. Hadn’t thought about this before. Thank you.

Great article, Nathan. The idea of a price to value ratio is really helpful to think about, especially when it comes to figuring out pricing. The value side of the equation is much harder to quantify. Do you think a proxy metric is a good substitute? How would you quantify value?

Convert Kit is one of those amazing companies where no matter what the price, you must use it. It’s a valuable business investment, not an expense. Don’t know what I’d do without you.

Deena

Very great post. We charged less per client than we could to get “the benefit of the doubt,” and it paid off.

We hate the companies where we feel “fully monetized”. The movies might get more of our business if we didn’t feel mugged every time we went. Sometimes I feel a little exposed by ActiveCampaign. I feel not great whenever I deal with my Gym (oh, that’s extra). Some hotels do it.

In the moment, they get the most out of this particular transaction, but they leave me wanting to find other options.

We used to say “Don’t Monetize Me, Bro.”

Great article. However, one could come away with the conclusion that charging the least amount possible is the best thing to do. Maybe it is. But there are other factors at play too. For example, people often associate quality with price.

Nathan,

Thank you for writing this. It’s really a life saver as I have been able to extract what I need as regard pricing my software.

I just subscribed to your newsletter.