“If you grow too fast it can kill the business.”

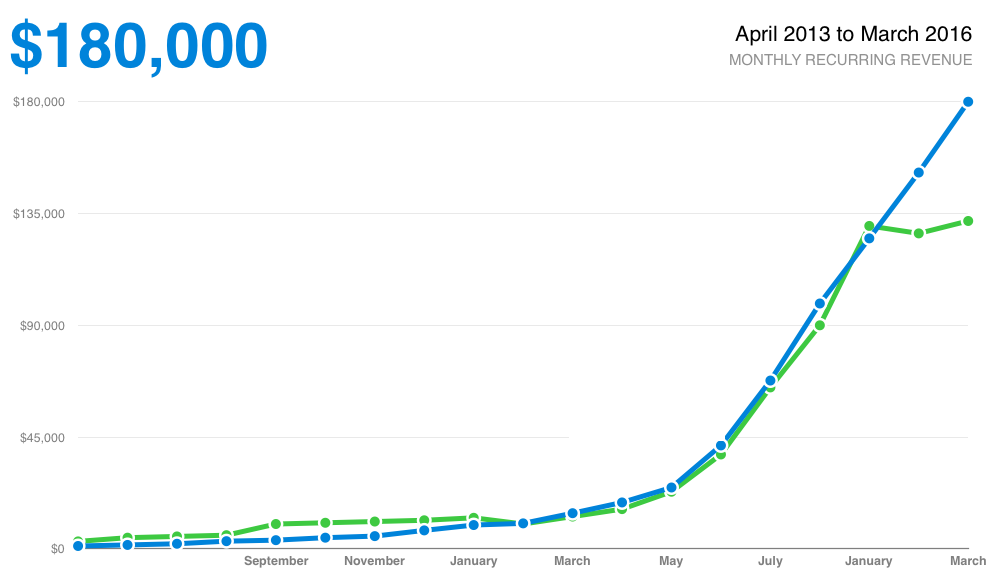

After spending years fighting for even a tiny bit of growth, ConvertKit was now facing a totally different kind of problem: more growth than we could support. In October, November, and December we were averaging growing 40% per month. Recurring revenue went from $25,000 in September to $98,000 in December. That meant thousands of new customers who all needed help and support and millions of new emails for our servers to process.

Did we have too much of a good thing too quickly?

We quickly moved our two contract developers to full-time and then brought on another full-time developer. We also hired in support, marketing, and sales bringing our team to 14 full-time employees, plus a handful of contractors helping with Facebook ads, deliverability, design, and more.

But even with the all the new team members we were just barely keeping up. A group of spammers attempted to use ConvertKit for sending their spam emails—it took 2 developers almost full-time for 6 weeks to fight them off. Our support team was doing incredibly well, but still struggling under all the new accounts.

Worst of all, despite the growth, we were barely clinging to profitability. When I talked to other business owners about this they all joked and said, “Well, those are good problems to have.” Yes, but they’re still problems.

Runway

Back in June 2015 our revenue was at $10,000 per month, and we were down to our last $10,000 in the bank. Luckily that’s the lowest our bank balance ever got.

At the time those numbers didn’t look bad. We had a full month’s expenses on hand and a predictable revenue stream (no single customer made up more than 10% of our revenue). But as we grew we continued investing everything in the product and support. So in September we did almost $25,000 in revenue, but after expenses only added $1,000 to the bank account. Now—even though our bank balance grew each month and we were profitable—we only had about 12 days of expenses in the bank.

Huh, that’s a problem I never expected.

We had growth numbers that would make many funded startups jealous, but if revenue and expenses continued growing on the same path we’d soon be down to a week or less worth of expenses in the bank.

Looking for debt

I’ve wanted to wait as long as possible (or forever) to raise money for ConvertKit, so the first place I looked for a safety net was for a line of credit from our bank. A few years ago when I had over $100,000 in the bank they would offer me a line of credit almost every time I was in a branch. So I figured I’d get that as a safety net. Not to spend, but just in case something went wrong.

Unfortunately Wells Fargo took one look at my greatly diminished bank balance and said the credit line was no longer an option. I’d always heard that you should get a loan when you don’t need it because once you do it won’t be available, but it was painful to live that out in person.

I met with three other traditional banks, but none of them understood the SaaS business model and didn’t like that our business had no assets. If a software company shuts down, what can you sell? Macbooks and iPhones?

It was odd to think they would have rather loaned me $1,000,000 to buy a building then $100,000 to grow my software company. One has collateral, the other doesn’t.

I made progress on a small $50,000 line of credit with one bank, but then I found out I had been 30 days late on a credit card payment back in 2014 and the credit line fell through.

Raising capital

Remember those growth numbers? It turns out hitting $1m ARR growing 30%+ month-over-month is pretty good. That means when it came to raising funding we had plenty of options. I was down in San Francisco for a conference and so I met with a handful of VCs. The response was mixed, but overall good. So I started to map out what it would look like to raise $3m at a $20m pre-money valuation (10-12x ARR).

That looked possible, but a little harder due to the tech valuations that had just crashed in the public markets.

But I also talked to a few founders at the conference. I ran into Dharmesh Shah (CTO of Hubspot) and asked his opinion. He had a very balanced opinion on bootstrapping vs raising VC funding. After seeing how stressful it was for me personally to grow with such a small bank balance, Dharmesh suggested raising a small round of $1m on AngelList. That way I didn’t give up control, but could bring in plenty of cash quickly.

Since I have a pretty strong personal network and excellent growth numbers that wouldn’t be too hard. It felt like a good way to bring in some smart investors who could add value, but without fully committing to the VC path. And it would entirely solve my cash worries.

I started mapping out who I wanted to ask first and started those early conversations. My idea was to already have a few hundred thousand in commitments before I announced fundraising publicly.

One last conversation

On the last day of the conference I was having a conversation with a founder from Toronto when a guy named Mike walked up and said “hi”. He was also from Toronto, and looked really familiar, but his badge was turned around so I didn’t know who he was. After he walked away the first founder I was talking to said, “That was Mike McDerment the CEO of Freshbooks.”

Oh!

I’ve been a fan and customer of Freshbooks for years. They were self-funded for a very long time until recently raising a large round of funding when they had over 200 employees. I’m pretty sure Mike’s dealt with similar problems. Unfortunately I just missed a great opportunity to ask him about it.

I thought about that for the next few hours and then decided to reach out on Twitter. He was still at the conference, but with 4,000+ attendees my chances of running into him again were pretty slim. He quickly replied on Twitter and said he’d be happy to meet for a few minutes to talk bootstrapping.

As the current session neared a close I started to get up to find a good place to meet him. But was quite surprised to see that he was sitting 2 seats away at the end of the aisle! Total coincidence.

After listening to the cash flow problems for a few minutes Mike repeated it back to me: “So you are at $130,000/month in revenue, just barely profitable, almost no cash in the bank, expenses are growing lockstep with revenue, but you’re adding almost $30,000 per month in revenue?”

Yeah, that sums it up.

He continued: “Well, it’s not easy, but all you have to do is be disciplined and not increase expenses for a few months and you’ll be nicely profitable.”

Getting support under control

We actually didn’t have to cut our expenses to be profitable—instead we just needed them to increase a lot more slowly. That felt near impossible under crippling growth and the load on our support team.

At the same time it became obvious that my director of support and I had very different views on how to run our support team, so I had to let him go.

As I pushed for a metrics driven approach to support I learned two interesting things:

- Our weekly ticket volume was increasing, but slower than the rate we were acquiring new customers.

- Our insanely high support queue levels (250+ tickets) were staying fairly steady. Meaning we were keeping up with the new volume, but could never get ahead.

Those two things told me that this was a solvable problem. We had the team in place (even down one person) to get our support queue under control.

It’s like doing the dishes. If your kitchen is a disaster you can keep doing an equal amount of dishes to what you just got dirty from making dinner, but your kitchen will always be a disaster. Yet you’re doing all the new dishes!

Or you can push hard one time and deep clean the kitchen. Then you can go back to doing the same amount of work to maintain the default state. Except now the default is perfectly clean rather than a disaster.

I shared that analogy, along with the metrics and observations, with my support team. My goal was to take us from a median of 24-30 hour response times down to 1-2 hour response times in 30 days.

Instant results

We pulled together as a team and dropped down to median one-hour response times by the next day. I was shocked. We accomplished more with a smaller team. I asked each person on the support team individually over Slack: “What changed?”

They all said basically the same thing:

“Before we were drowning under an impossible pile of work. We needed more team members, fewer bugs, and better systems. It felt like we were sinking deeper rather than making progress.”

“You showed us that it was possible. That hope and teamwork is all we needed to get it done.”

Those results proved that we didn’t need to keep hiring—at least not at the same rate—in order to support our growing customer base. Profitability looked quite possible.

At the same time our development team worked to get our servers more efficient and I renegotiated our contracts with Stripe and Mailgun. Then cut every other expense that wasn’t necessary.

A 6 month plan

Ryan Delk, one of our advisors, recommended that we work towards 3 months of expenses in the bank as a baseline. Most businesses would need more, but in SaaS we have the world’s most predictable revenue stream. Customers pay us every month and no single customer makes up more than 1.5% of our revenue.

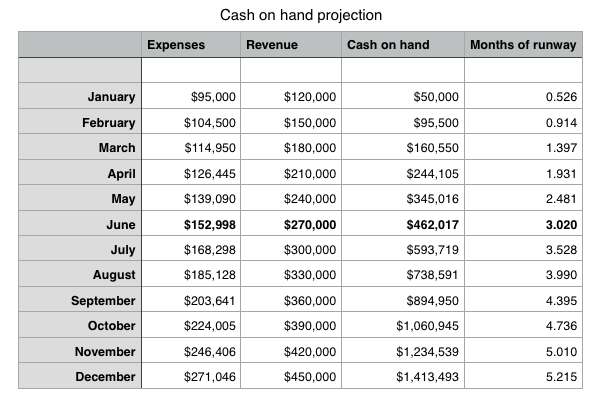

I created this spreadsheet of what we would need to do in order to get to 3 months of expenses in the bank.

This assumes expenses growing at 10% each month and revenue growing at $30,000 per month. Now a few months in we’re on track to hit $460,000 of cash in the bank (3 months of projected expenses) by July 1st.

On this chart you can see revenue (blue) compared to rough expenses (green) each month.

After being denied for a loan and turning down offers to raise capital, we are bootstrapped and profitable.

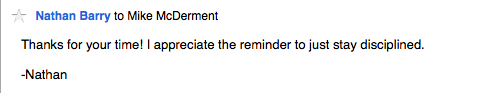

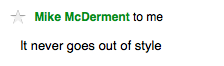

I emailed Mike McDerment from Freshbooks to thank him for his advice to stay disciplined:

Discipline, no matter how hard it is, never goes out of style.

Thanks for the useful information once again Nathan! This stuff maybe does not feel like a luxury problem, but since you fully comitted to Convertkit it’s better than the opposite! :)

Thanks for being so upfront and naked to us all. You got some really good advice. I’ve been an entrepreneur all my like (I’m 61) and always bootstrapped. Funny thing is I’ve been an angel investor and president of an angel group for a couple years and fight like hell to talk most entrepreneurs out of raising money that way, and never for the reasons you were facing. Even if you “keep control” you still have to sell the company to pay back the angels.

Keep up the good work. And keep sharing

This is a great story. I have been a follower since the start! It is awesome to see how it’s going.

Great article.

A very interesting read, one of the few articles I’ve read all the way through online. Normally very much the skimmer.

Brilliant insight into the running of your company and its even nicer to see that even with the same team you managed to solve what was a serious long term issue and without taking on debt.

Good for you Nathan.

Love the transparency. Thanks for sharing Nathan. I am a new and happy convertkit customer and am glad to see the move in the profitable direction. You guys are working hard and earn it. Customer experience goes along away. Good up the good work.

Awesome post Nathan! I love all of the personal specifics. Running a business with a little in the bank is indeed very stressful. Great job on figuring out a way out of the trap without giving up any of your company! Thanks for sharing.

I certainly didn’t expect the level of stress. Though I think many people could handle it better than I did.

I just wanted to thank you for always sharing. I really appreciate the transparency and am glad you’re still writing posts like these. They’re super insightful!

Thanks Sean! Excited to see you in person next week.

Gotta work hard to be an overnight success! ha.

Great story, just recently found your blog. I’ve always wanted to get into an SaaS model, but I don’t have the same background as you, most of my experience comes from running an agency, not hardcore development.

Good luck!

Hey, thanks for these posts,this is really something to boost my morale on my startup journey. My question is how are you able to grow convertkit so fast, I guess marketing takes a large chunk of your expenses, is this correct?

I’ve written about that in a few other articles, but the big channels are direct sales, affiliates, and word of mouth.

Impressive results under what seems like a high-pressure situation.

Thanks for all your help and support during this process!

Very, very interesting and enlightening. Many thanks for taking the time to write such a thorough piece, Nathan!

Thanks Kyle! Hope things are going well in your world.

Thank you for sharing the story. I’m following ConvertKit from day 1, it’s great to read this updates and how you are solving problems. Staying disciplined is a simple solution, but difficult to keep doing.

Thanks for sharing Nathan! It’s good insight for people like just starting up. Great teamwork!

Nathan, that was great storytelling and great lesson! Thank you for sharing. I continue to follow the ConvertKit journey ….. you’re an inspiration for many new entrepreneurs.

Nathan,

Love your candor and sharing.

You’ll have future challenges but the cash flow roller coaster will test your resolve.

Stay strong.

Mike

I think that all of us who stare at ConvertKit’s numbers on Baremetrics imagine everything is so rosy for you and your team. It’s great to get a view into the reality, to see that view into the trenches where the basics of business still apply. Does it cash flow? Is it profitable? Am I managing the growth correctly? It seems like you’ve handled all of the above with some serious skill. Inspiring Nathan!

I think it’s great if you go it alone. But you’ll want the VC money if your vision becomes bigger than your personal/business resources.

Consider listening to a recent John Warrillow podcast where he talks to the co-founder (Aaron Houghton) of iContact. They grew through raising convertible debt during their scaling-up period. Very creative on their part.

Again, impressive you are now controlling cash instead of it controlling you.

Nathan, this is a great story man. You truly deserve the great success. Keep it up!

So happy for you Nathan. You’ve done an amazing job. I was particularly impressed with how you solved the support problem. Thanks for sharing all these nuggets with us. Onwards and upwards!

Nice post, Nathan.

“It never goes out of style”

That’s quite a good reply from Mike.

What an incredibly useful post, even for those of us who don’t run a hugely successful new business. Thank you Nathan

I had followed the growth (and as a customer am a tiny part of it), but didn’t think of the problems that could be causing. Color me all the more impressed.

Thank you so much for this really useful information and sharing that great piece of advice Nathan. Priceless! Keep doing what you’re doing. I love my convertkit!

Excellent. And not just a lesson about staying afloat, but a lesson on how to run a profitable business for the long term – whether the business is making 10k, 100k, or a miilion/month.

Out of curiosity, which conference we’re you at? Sounds like a good one :-)

Great post, Nathan. Glad to hear you’ve all worked through it.

Wow – thank you, Nathan. I have a ton of lessons to learn from this.

This was an awesome read, and personally knowing how hard it is to stay this level-headed through this particular kind of stress I just wanted to say how much I appreciate that aspect of what’s going on here and how you navigated this.

Also, Mike McDermot is the classiest, right?

Great transparency Nathan, thanks for sharing – and congrats.

I’m invested in a a few other SaaS businesses and have some suggestions/questions/thoughts/rants:

1. You should check out David Skok’s SaaS metrics to compare yourself against other SaaS businesses, http://www.forentrepreneurs.com/saas-metrics-2/. Specifically check out your gross margins – you should be getting close to 80%. If not you may need more “discipline” (though to be fair there seem to be some questions about whether that 80% number is still valid as SaaS companies are realizing that customer success and support are higher than expected). Also look at your Cost of acquiring customers and compare it to your LTV – there should be about a 3-to-1 ratio.

Benchmarking yourself against these metrics should help predict these issues in the future.

2. If you look at SaaS valuations (even public companies) the value of the businesses boils down to one issue – growth. When you do think your growth will start to flatline? You’re in a highly, highly competitive space. I suspect that raising money from investors will require showing how you’re going to get grow revenue by 10x. It will almost definitely require pivoting to a bigger opportunity that will take $$ and require going unprofitable. So while getting to profitability is awesome in the short run … in the end you’re optimizing for a metric which the market isn’t rewarding. Which brings me to …

3. What is your personal goal? To hit $XM a year in revenue and sell? To run a profitable cash-generating business? To IPO? I’m just asking because it seems like you have to know where you’re going to make these decisions. There are no right or wrong answers but the decisions you will limit your options.

For example, if getting to $50M in ARR is the goal you will almost definitely have to raise money and should probably focused on growth at the expense of everything else. Of course if your goal is to hit $2M & be profitable in 2016 you’re on the right track.

No need to respond – or feel free to email me if I can help out. Either way thanks for sharing your amazing journey and congrats.

Kevin

Thanks for all the thoughts Kevin! I actually don’t think growth will flatline—at least not in the next year or so. Since word of mouth and referrals are the big channels, we’re reaching more and more people each month.

We may see different issues around $1m MRR, but I think we can never go wrong optimizing for staying profitable.

Most of the enterprise SaaS metrics people cite just aren’t that relevant to us. We spend very little to acquire each customer right now, so we simply don’t need to spend millions to grow right now. That may change later, but until then we’re going to stay profitable.

My personal goal is to build a great company. To me that means taking great care of our customers and being highly profitable. We’re already past $2m ARR. The goal is to get to $6m ARR by December 31, 2016—and stay profitable.

Great line: “Discipline never goes out of style!”

“all you have to do is be disciplined and not increase expenses for a few months and you’ll be nicely profitable.”

It is crazy how simple, yet overwhelming the answers can be. Glad to hear things are going so well and I am proud to be a user of convert kit.

What if our government could be as transparent? Many smart people here are benefitting from your transparency. It builds trust, shows your commitment and inspires more discipline from us all. Thanks Nathan.

Nathan, this is really insightful and inspiring. I can see another 12 months and you’ll have built your team to manage these situations for you.

I can’t offer any assistance, but reach out to your community you may find some answers & support there through your growing pains

Glad it’s come together so well Nathan. Simply loved the leadership you demonstrated with your support team – never ceases to amaze me how removing a piece of the puzzle and engaging a team can lead to breakthrough results.

Keep up the great work!

Thanks so much Mike! I appreciate you taking the time to talk through this with me. Your advice has been incredibly helpful.

It’s amazing to see where you’ve come from, nearly scrapping the whole project, to making a significant market pivot, and now facing real growing pains, and overcoming them. As a cofounder of a tech startup, I’ll keep this story in my back pocket, it’s a good lesson about being profitable. Although the message is stupid-simple (‘spend less, keep growing’), it takes a good story like this to make it memorable.

Hi Nathan. I’m taking your advice (in past articles) and getting to launch a product soon and reduce consulting but how are you able to market mostly based on word of mouth and referrals to achieve these sort of revenue. Please email me if you will!

Hey Nathan

I am also founder of bootstrapped startup (not saas, but ridesharing) but having recurring (monthly renewal) paid customer.

I can correlate every line of this post.

Why not shoot one more post about more insights as well. :)

Thanks,

Raxit

Btw, Fantastic Post. Thanks

Hey Nathan, so what were some high-level changes with the structure of your support team? How did the kitchen go from dirty to clean?

Awesome report Nathan, keep em coming. Love seeing the real numbers. Best of luck with the rest of this year!

Startups are a great test for discipline, passion, team work – sticking it out.

So growing revenue with growth in expenses is not a scalable model. As the startup reaches a high growth milestone, the rules of the game change. Expenses cannot grow at the same rate. There is need to optimise so that there is greater efficiency and hence burn rate is controlled such that the firm has 3 months of cash in hand or more if it is not a SAAS business. Debt would really be not a feasible option.

Nathan, thanks so much for being so open about the good and bad in your business and providing so much detail. The timing is great for me as I read “Built To Sell” this weekend and was already trying to fit the SaaS business model into the context of this book. Your story gives me some real world examples to solidify some of the concepts.

I was not so lucky to spend a decade in software support. So many aspiring SaaS Entrepreneurs fail to take support costs into account when developing their product (especially when pricing it). When still in the development phase interfacing with your customers seems to be a necessary evil and gives you great insight into their needs. But after a while it gets to be very painful and expensive.

****TIP*** While at Intuit(Lacerte) We took the top 10 call generators and created multimedia help videos in the specific sections of the product that generated the calls and used support staff to help us build out the content in a way that worked best for customers. It was very effective way to reduce call volume (support expense) and let us focus more on unique issues. Investing in self support tools will be a great step.

That was an awesome take on an epic story. Loved it. It’s something you don’t run across in as much detail, but I am sure will have major applicability at some point. Keep rockin!

Hi Nathan,

This is an amazing story: thank you for sharing with us and being so transparent. Outsiders often assume that because you are growing all is fine when you might be facing a different set of problems at different growth stages!

Cheers

JC

Nathan! Great stuff man! Love these detailed posts like this. inspires me to write more “behind the curtain” types of posts like these myself.

I’d love to connect sometime. We’re in a somewhat similar boat for sure.

Oregon based SaaS (southern Oregon).

2.5 years old

$175k/mo MRR in March (growing steadily but not growing $30k/mo like you though! Great work man!)

… yet we’ve taken a slightly different approach which is probably reflecting in that your current growth rate is much higher than ours. But our full time staff is 6, profits… pulling about 45% net each month after all salaries…

… but now we’re hitting a point where we’re bottlenecked on some growth initiatives and bottlenecked on tech development (hiring for both of those roles as we speak). I hired behind the curve a bit and we’re now feeling the pinch. But we’ll tackle it!

Man, if you’d be game I’d love to connect. You’re here in Oregon right? Hit me up. Let’s chat. Would love to chat through some of the things that work crushing it for us on our customer success side of things that you guys can borrow and just systems type stuff that may help ya.

Hey Trevor! That does sound really similar. Though I’m in Boise, Idaho. Let me know if you ever come to Boise.

Great info Nathan. We are where you were in 2013 and ironically enough ours is a support team optimization SaaS. I have not seen anyone write about the “support wall” by mapping it to financials before. Very informative and thanks for sharing this!

Thanks for being such an open book, Nathan. It’s really insightful to see what’s happening under the hood as you grow.

Great article. With actual numbers! And lessons learned! Thanks for sharing. What was the single biggest expense that you cut?

Nathan,

Someone shared this article with me as a way to support his following statement, “I’m a little hesitant to use Convertkit because the company still seems very young and maybe unstable.”

I get his point, but to be honest, this article makes me want to be a ConvertKit customer even more. The journey and challenges you guys are going through is a path that has been walked by other successful SaaS companies.

After reading this… I have no doubt ConvertKit will thrive, keep growing exponentially and of course, be profitable.

Grateful for the knowledge you have shared here.

Thanks for the great post Nathan. Really an eye opener for those looking for some money tips on running a startup.

I’m a ConvertKit user and was just fiddling with the landing pages and had to do some integrations under Automations. For some reason I checked out Gumroad and their testimonial lead me to your site. I know you for quite a while, and I can attest to the level of support by your team – I’ve submitted 2 tickets this month and both are superb. I am very impressed.

Knowing your story as an entrepreneur and with bootstrapping, I can totally relate. I’ve been wishing to do the same and build my startups from the ground up. And yet I’m always stubborn to even find funding. Just wanted to let you know Nathan that I enjoyed this piece of your life as much as I enjoy ConvertKit.

Thank you for inspiring me.

I hope I would be able to seek your advice someday :)

So nice of the Freshbooks CEO to selflessly help you out too!

Thank you for everything that you do, Nathan.

Awesome post, Nathan! Staying disciplined about keeping expenses low is a habit that anyone – from individuals managing personal finances, to CEOs of companies – should constantly work on cultivating. Every dollar not spent is a valuable metric in its own right.